July 09, 2020

City Colleges of Chicago released its tentative FY2021 operating and capital budgets on June 23, 2020. The total budget is proposed to be $441.0 million. This a 1.5%, or $6.6 million decrease from the FY2020 budget of $447.6 million.

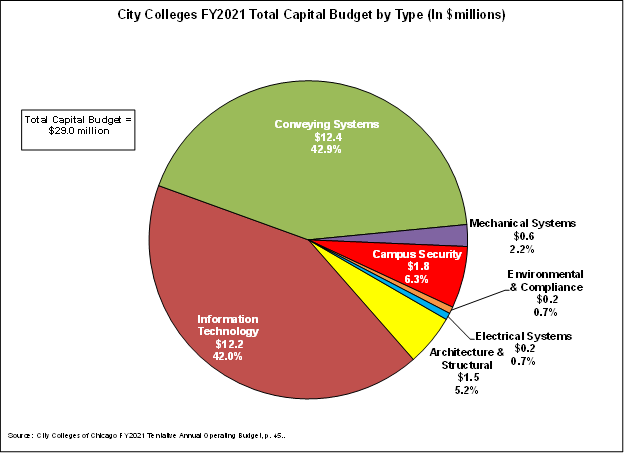

This blog presents highlights of the City Colleges FY2021 $29.0 million capital budget program and its long-term liabilities.

City Colleges prepares a capital budget at the same time as the operating budget. This is usually part of a comprehensive five-year capital improvement (CIP) plan. The last CIP was published in FY2018 and was to conclude in FY2023.[1] This year, however, faced with uncertainty over current and long-term funding due to the COVID-19 pandemic, City Colleges will implement a one-year stopgap capital plan. The plan will focus on essential life safety repair and maintenance projects. Technology expenditures in the capital budget will include updating hardware and software licensing agreements. Long-term capital plans are being postponed until the fiscal situation stabilizes.[2]

The City Colleges’ Capital Fund provides pay-as-you-go funding for a substantial portion of its major building projects, as well as the improvement of existing structures. In FY2021 the total capital budget is proposed to be approximately $29.0 million. This amount is a $13.7 million or 32.0% reduction from the FY2020 capital budget request of $42.6 million. Approximately 65% of the proposed FY2021 budget or $18.9 million, will be funded from City Colleges current receipts. The remainder, $10.0 million, will be bond funded. No State of Illinois funds are anticipated in this budget.[3]

The single largest amount of capital funds, or $12.4 million, which is 42.9% of all funds, will be spent on conveying systems, which are elevators and escalators. This includes funding for several Malcolm X College elevators which failed City of Chicago Department of Building inspections in January 2020.[4] The next largest amount, or $12.2 million, will be used to pay for information technology projects. Smaller amounts are earmarked for mechanical systems, campus security, electrical systems and architectural and structural projects. Unlike previous years, no funds will be earmarked for equipment or academic enhancement projects.

City Colleges Long-Term Liabilities

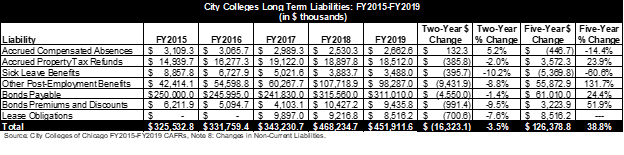

The majority of City Colleges’ long-term liabilities are incurred for debt used to fund capital purposes. In FY2019, 72.7% of all long-term liabilities, or $329.0 million out of a total of $452.0 million, were for bonds payable, bond premiums and discounts and lease obligations. This section of the blog post examines trends in City Colleges’ long-term liabilities, including tax supported long-term debt.

Long-term liabilities are all of the obligations owed by a government over time. Increases in long-term liabilities over time could be a sign of fiscal stress. For City Colleges they include:

- Bonds Payable: amounts reported for tax supported long-term debt;

- Bond Premiums and Discounts: deferred and amortized over the life of the bonds using the effective interest method;[5]

- Accrued Compensated Absences: liabilities owed for current employees’ time off with pay for vacations, holidays and sick days;

- Accrued Property Tax Refunds: property taxes that may be refunded to taxpayers in the future;

- Sick Leave Benefits: payments to retirees for accumulated unused sick days. Eligible employees are administrative and non-bargained-for employees hired prior to January 1, 2012 and certain union-represented employees pursuant to their respective collective bargaining agreements, who have served continuously for 10 years or more and are eligible for an annuity under the State Universities Retirement System (SURS);[6] and

- Net Other Post-Employment Benefit (OPEB) liabilities: Beginning with the FY2018 CAFR, City Colleges of Chicago implemented GASB Statement 75 requirements to report net OPEB liability as the portion of the present value of projected benefit payments to current active and inactive employees that is attributed to those employees’ past periods of service less the amount of the OPEB plan’s fiduciary net position.[7]

- Prior to FY2018, under the requirements of GASB Statement 45, net Other Post-Employment Benefit (OPEB) liabilities were reported as the cumulative difference between the annual OPEB cost and the employer’s contributions to its OPEB plan.[8]

- As a result of the reporting change for other post-employment liabilities involved in implementing GASB 75, the amount of City Colleges long-term liabilities reported has increased substantially. This is because it reflects a more holistic approach to measuring the liabilities of the government, which the previous net other post-employment measurement did not. The amount owed by City Colleges for retiree health insurance to its pension funds has not significantly changed. It is only being reported more transparently.

The District’s total long-term liabilities decreased by $16.3 million, or 3.5%, between FY2018 and FY2019. FY2019 is the most recent year for which audited financial data are available. There were two principal drivers of this decrease:

- Bonds payable fell by 1.4%, declining by $4.6 million from $315.6 million to $311.0 million; and

- Other post-employment benefits reported decreased by $9.4 million, or 8.8%, falling from $107.7 million to $98.3 million. The decrease was attributed in part to reductions in benefit payments and the difference between expected versus actual financial experiences.[9]

Over the five-year period between FY2015 and FY2019, long-term liabilities increased by 38.8%, or $126.4 million. The major reasons for the rise were a $61.0 million, or 24.4%, increase in bonds payable and a $55.9 million, or 131.7%, increase in other post-employment benefits. As noted above, this increase in other post-employment benefits reflects the reporting change for other post-employment liabilities required by GASB Statement 75. The amount owed by City Colleges for retiree health insurance has not significantly changed. It is only being reported more transparently and holistically.

Beginning in FY2007, through an intergovernmental agreement, City Colleges transferred its outstanding capital debt from general obligation bonds issued in FY1999 and FY2007 to the City of Chicago. At the time, 100% of the outstanding debt was in the form of capital leases, which required a $32.7 million payment in FY2007. The FY1999 issuance totaled $389.0 million and the FY2007 series totaled $39.1 million. In accordance with the transfer, the City of Chicago now levies the property taxes needed to pay the annual debt service for those bonds on behalf of City Colleges of Chicago.

The District completed its first bond issuance since the transfer of its general obligations to the City of Chicago of $250.0 million in October 2013 to fund its long-term capital plan. On December 11, 2017 City Colleges issued $78.0 million in Unlimited Tax General Obligation Bonds (Series 2017) for capital purposes. The bonds were issued with interest rates ranging from 4% to 5% with payment dates of June 1 and December 1 of each year.[10] Bond premiums and discounts are deferred and amortized over the life of the bonds using the effective interest method.

[1] City Colleges of Chicago, FY2020 Tentative Annual Operating Budget, p. 42.

[2] City Colleges of Chicago, FY2021 Tentative Annual Operating Budget, p. 44.

[3] City Colleges of Chicago, FY2021 Tentative Annual Operating Budget, p. 44.

[4] The elevators in question were new; there is pending litigation regarding the failure of the elevators to function properly and pass inspection. Information provided by City Colleges of Chicago, June 23, 2020. See also City of Chicago Building Permit and Inspection Records at https://webapps1.chicago.gov/buildingrecords/inspectiondetails?addr=302386&insp=13062048.

[5] City Colleges of Chicago FY2019 Comprehensive Annual Financial Report, p. 25.

[6] City Colleges of Chicago FY2019 Comprehensive Annual Financial Report, p. 41.

[7] Governmental Accounting Standards Board, Summary of Statement No. 75: Accounting and Financial Reporting for Postemployment Benefits Other than Pensions at: https://www.gasb.org/cs/ContentServer?cid=1176166370763&d=&pagename=GASB%2FPronouncement_C%2FGASBSummaryPage.

[8] City Colleges’ OPEB Plan includes health and life insurance for retired employees. Currently, City Colleges provides subsidized coverage for medical, dental and vision insurance for a period of 10 years from the employee’s retirement date. Retired employees are covered for life insurance for a period of six to ten years, with City Colleges paying the cost of the coverage. During the ten-year subsidy period, City Colleges pays approximately 85% of the cost of the premiums and retirees pay approximately 15% of the cost of the medical, dental and vision coverage. City Colleges of Chicago FY2019 Comprehensive Annual Financial Report, p. 42.

[9] City Colleges of Chicago FY2019 Comprehensive Annual Financial Report, p. 43. Effective October 5, 2017, the District eliminated OPEB for newly hired administrators and nonunion employees; this reduced obligations going forward. See City Colleges of Chicago FY2019 Comprehensive Annual Financial Report, p. 41.

[10] City Colleges of Chicago FY2018 Comprehensive Annual Financial Report, p. 44.